The UK property market has been a topic of much discussion and debate, especially as property prices continue to soar higher. Understanding the factors behind this trend is crucial for potential first time buyers, home movers and buy to let investors. In this blog post, we will explore the key reasons why property prices in the UK are on an upward trajectory.

Why do Property Prices Continue to Soar higher?

1. Broken Money

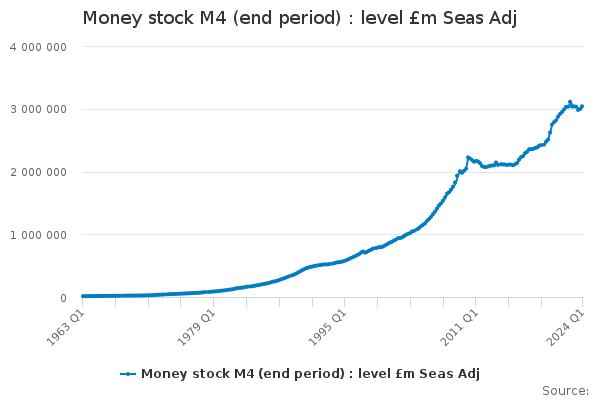

In today’s economic landscape, the relationship between fiat money and house prices is a topic of significant interest. When governments engage in money printing and overspending, it leads to an increase in the supply of money, which often results in inflation. This inflation reduces the purchasing power of money, prompting people to seek stable stores of value to protect their wealth. Property becomes a preferred choice, driving up house prices due to increased demand.

The inflationary pressures created by the expansion of fiat money and fiscal dominance lead to higher demand for property. As people anticipate further inflation, they invest in housing as a hedge against the devaluation of fiat money, resulting in higher house prices. This has been devasting for first time buyers as they have been left unable to get onto the housing ladder, and at the same time their cash savings and wages have been devalued in real terms.

2. Low-Interest Rates

One of the primary drivers of rising property prices is the historically low-interest rates. Low-interest rates make borrowing cheaper, encouraging more people to take out mortgages and buy homes. This increased demand naturally pushes up property prices.

Interest rates, which had been falling, started rising at the beginning of 2022 and continued to do so until last month. The UK’s public debt is now over 100% of its GDP, meaning a large part of the economy is focused on paying off this debt. To manage this, central banks might need to lower interest rates, but this could lead to higher inflation. Alternatively, the government could raise taxes or cut public spending, but these measures could harm institutions and infrastructure, potentially leading to a recession. The situation is challenging, as the high debt and cost of living crisis could lead to a debt spiral.

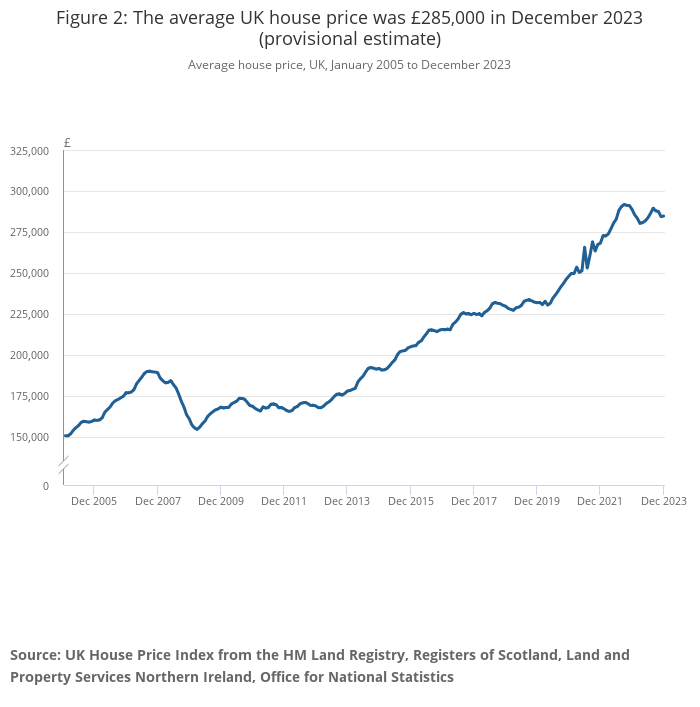

The latest UK House Price Index from the Office for National Statistics reveals that house prices have decently slowed and even declined in London as people move to more affordable areas. Conversely, house prices in the northern regions of England have continued to increase.

As interest rates are starting to be cut, it is likely property prices continue to soar higher in the UK, based upon historic interest rate trends.

3. Limited Housing Supply

The UK has been facing a housing shortage for several years. The number of new homes being built is not keeping pace with the growing demand. This imbalance between supply and demand is a significant factor in the rising property prices.

4. Government Policies

Government initiatives such as Help to Buy and Stamp Duty reductions have also played a role in driving up property prices. These policies make it easier for first time buyers to enter the market, increasing demand and, consequently, prices.

One notable policy was the stamp duty holiday introduced a temporary stamp duty holiday in 2021-22 for residential properties worth up to £500,000. During this period, nine out of ten people buying or moving up the property ladder paid no Stamp Duty Land Tax (SDLT) at all. During the stamp duty holiday, house prices experienced a surge, rising by 8.8% over the year.

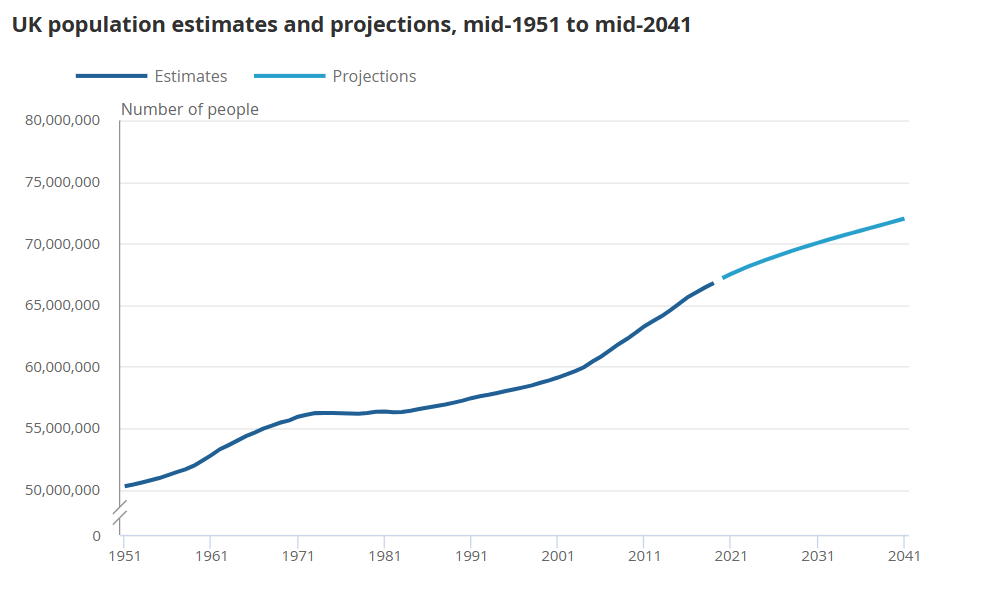

4. Population Growth

The UK’s population has been steadily growing, adding to the demand for housing. More people mean more households, which in turn increases the demand for homes and soar property prices higher.

5. Investment Opportunities

Property in the UK is seen as a stable and lucrative investment. Both domestic and international investors are keen to invest in UK real estate, further increasing demand and soar property prices higher.

Foreign buyers can purchase property in the UK without facing significant obstacles and do not need a visa. There are no legal restrictions which means that almost anyone, regardless of nationality, can invest in UK property.

To add to this foreign buyers are subject to the same stamp duty rates as UK residents and can also still get access to UK mortgage market, although with more rigorous checks.

6. Economic Factors

Economic stability and growth also contribute to rising property prices. When the economy is doing well, people have more disposable income and are more likely to invest in property. This increased purchasing power drives up demand and soar property prices higher.

Conclusion

In summary, the rising property prices in the UK can be attributed to a combination of a broken money, low-interest rates, limited housing supply, government policies, population growth, investment opportunities, and economic factors.

By staying informed and adapting to these trends, we can all better understand the economic situation and be informed about the UK property market. If you need any specialist mortgage advice on your own personal situation, please don’t hesitate to give us a call.

Credit: Image by freepik

Leave a Reply