The Essential Mortgage Protection Guide

Owning a home is a significant milestone, but it also comes with substantial financial responsibility. Mortgage protection is a crucial aspect of home ownership. It ensures your investment and family are secure in the event of unforeseen circumstances. Here’s the Essential Mortgage Protection Guide on why mortgage protection is vital and the options available to you.

Why Mortgage Protection Matters

Mortgage protection is about peace of mind. It’s the safety net that catches you and your family if life throws something unexpected your way. Without it, the dream of home ownership can quickly become a financial nightmare if you’re unable to meet mortgage payments due to a loss o income through death, illness or injury.

It is important to ask yourself the question: Could you or your family still pay your mortgage payments in the event of you or a named person:

Passing away?

Being unable to work due to a critical illness?

Being unable to work due to a unexpected illness or injury?

Life Insurance: The Foundation of Mortgage Protection

Life insurance is the cornerstone of mortgage protection. It provides a lump sum to your beneficiaries upon your death of a named party, which can be used to pay off your remaining mortgage balance. This means your loved ones can continue to live in the family home without the burden of monthly mortgage payments.

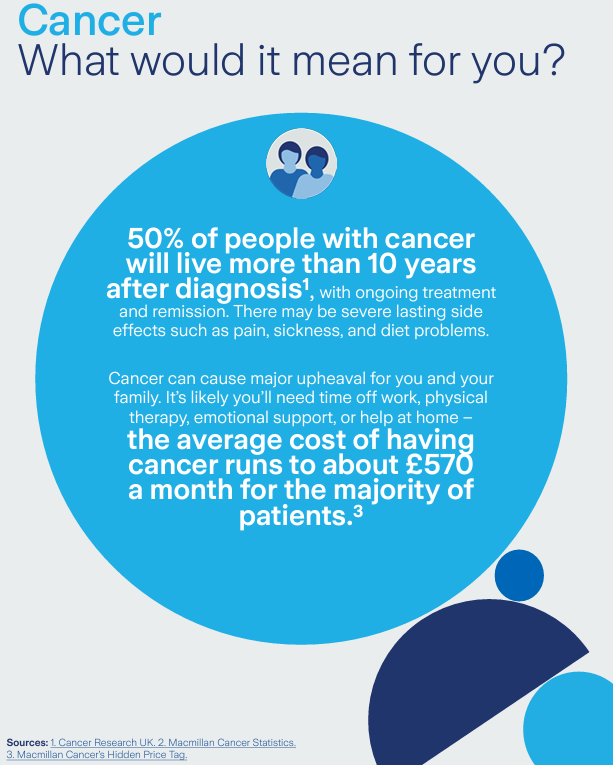

Critical Illness Cover: Protection Against Life-Altering Conditions

Critical illness cover is designed to ease the financial strain if you’re diagnosed with a specific serious illness. It pays out a tax-free lump sum that can be used to cover your mortgage payments, medical treatment, or any necessary adjustments to your home, allowing you to focus on recovery.

Income Protection: Ensuring Your Earnings

Income protection is a policy that pays out if you’re unable to work due to injury or illness. It would provide a regular income, typically up to a percentage of your salary, which can be used to cover your mortgage payments or other living expenses until you’re able to return to work.

Conclusion

Mortgage protection, although an optional extra, is an essential part of responsible home ownership. By combining life insurance, critical illness cover, and income protection, you can create a comprehensive safety net that secures your home and provides financial stability for your family, no matter what life throws your way.

Remember, the right protection is not a cost; it’s an investment in your family’s future and the home you’ve worked so hard to obtain. However, we appreciate it may not be financially possible to cover all areas. Consider speaking with a one of our experts to find the most suitable solution for your needs.

Credit – Image by pch.vector on Freepik

Leave a Reply