Are you confused about what exactly an SA302 Tax Calculations and a Tax Year Overviews are? Or maybe you’re wondering how to obtain these elusive documents. Fear not! In this blog, we’re going to guide you through the ins and outs of securing your tax calculations and tax year overviews.

These forms are particularly useful for self-employed individuals as it serves as proof of income – click here to find out more about self-employed mortgages.

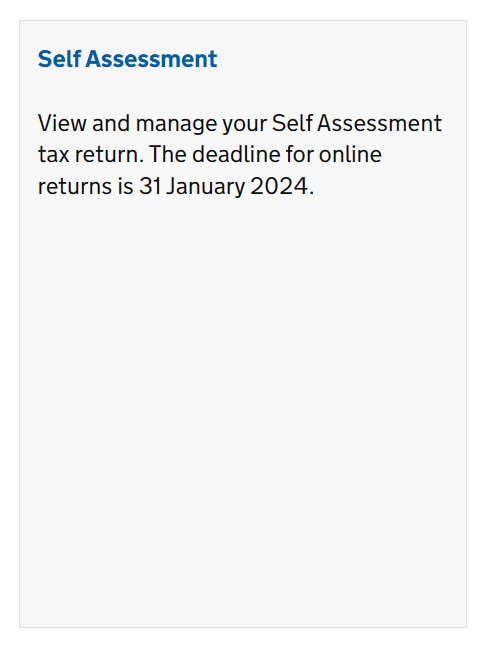

Step 1: Check Your Self Assessment Status

HMRC Online Account – Sign in using Government Gateway: Make sure you have access to your HMRC online account. If you don’t have one, create an account on the HMRC website.

Before diving into the details, ensure that you’ve submitted your Self Assessment tax return. Sometimes you won’t be able to access your tax calculation until 72 hours after submission. If you haven’t filed your tax return yet, complete that step first.

Step 2: Access Your Tax Calculation

Method 1: HMRC Online Services

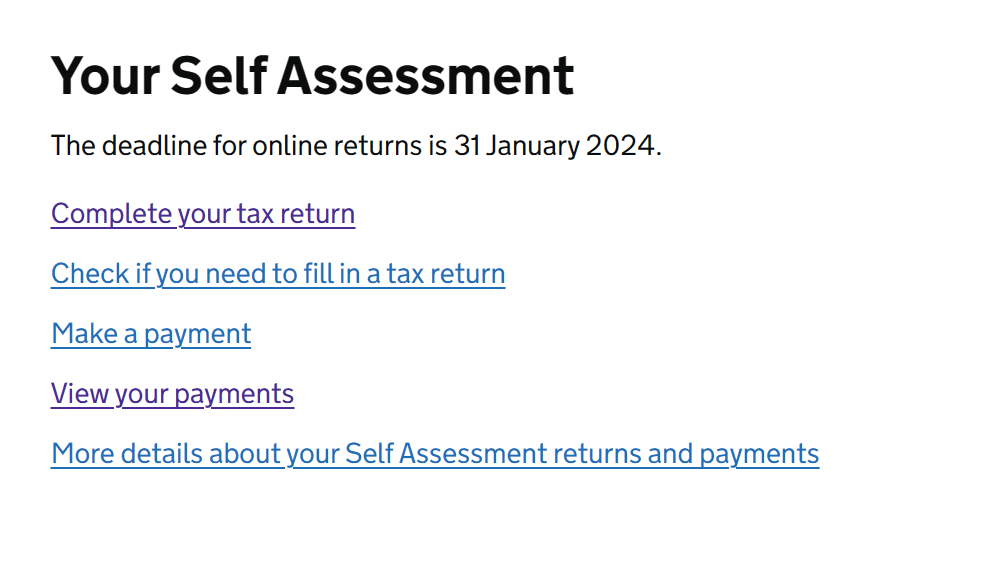

- Log in to your HMRC online account.

- Navigate to ‘Self Assessment’ and then ‘More details about your Self Assessment returns and payments’.

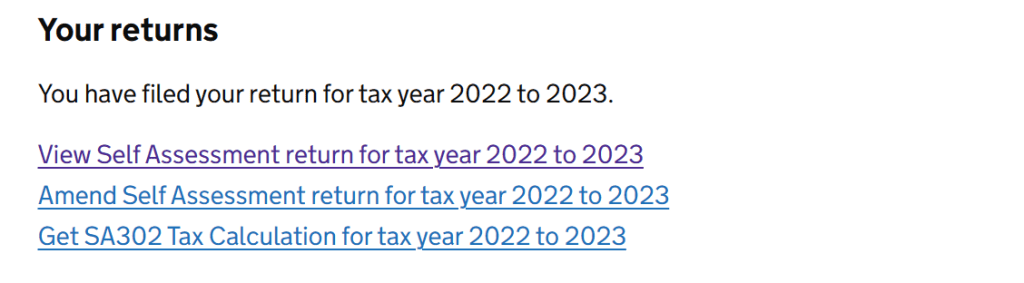

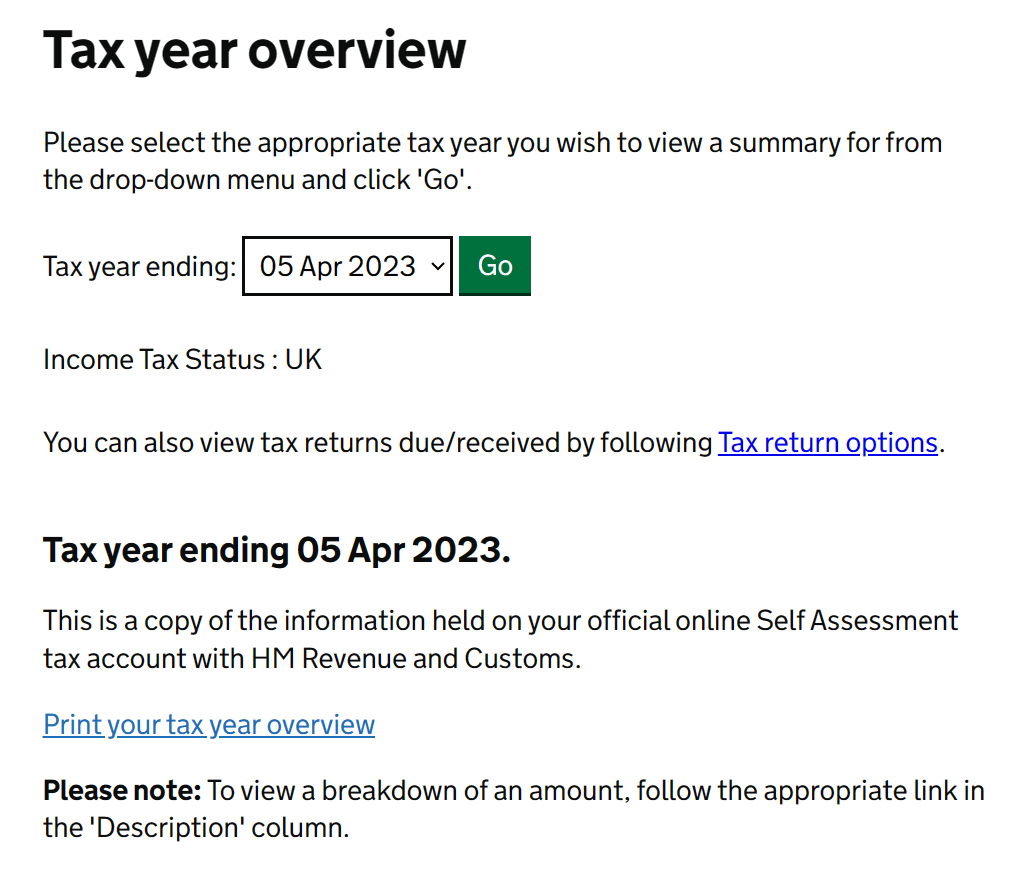

- Look for your View tax calculation and tax year overview options. You will also be able to change the tax year ending and press go, to view the specific years required.

- You will then be able to right click, print and save the tax calculation as a PDF. Also click Print your tax year overview and save as a PDF.

Method 2: Commercial Software

If you use commercial software for your tax return (or if your accountant does), follow these steps or request these documents form your accountant directly:

- Use the software to print your tax calculation (sometimes labelled as ‘tax computation’ within the software).

- If you encounter any issues, contact the company that provides the software.

- You can still print a tax year overview from your HMRC online account.

Step 3: Understanding your SA302 Tax Calculations & Tax Year Overviews

SA302 (Tax Calculation)

- The Tax Calculation / SA302 is a summary of your net income, tax due, and National Insurance contributions.

Tax Year Overview

- The tax year overview provides a snapshot of your tax position for a specific year.

- It includes details like total income, tax paid, and any outstanding amounts.

Step 4: Printing and Storing

- Once you’ve accessed your documents, print them for your records.

- Keep both the tax calculation / SA302 and tax year overview in a safe place.

Conclusion

Obtaining your SA302 Tax Calculations and Tax Year Overviews is essential for financial planning and meeting various requirements. Follow these steps, and you’ll have the necessary documents at your fingertips. Remember to keep your records organized and consult a tax professional if you have any doubts. If you have any questions or wish to find out how much you will be able to borrow – contact us today for free mortgage advice.

Credit – Image by pch.vector on Freepik

Leave a Reply